The Federation of the Swiss Watch Industry's export figures for 2025—from Jan-Nov, as December is still unavailable— tell a story of an industry navigating profound market shifts. On the surface, we see a 2.2% decline to CHF 23.4 billion through November 2025—a modest figure in an industry that has weathered far more turbulent periods. But that number, like a dial with multiple complications, requires careful reading to understand what's actually happening beneath the surface.

Three Variables to Keep in Mind

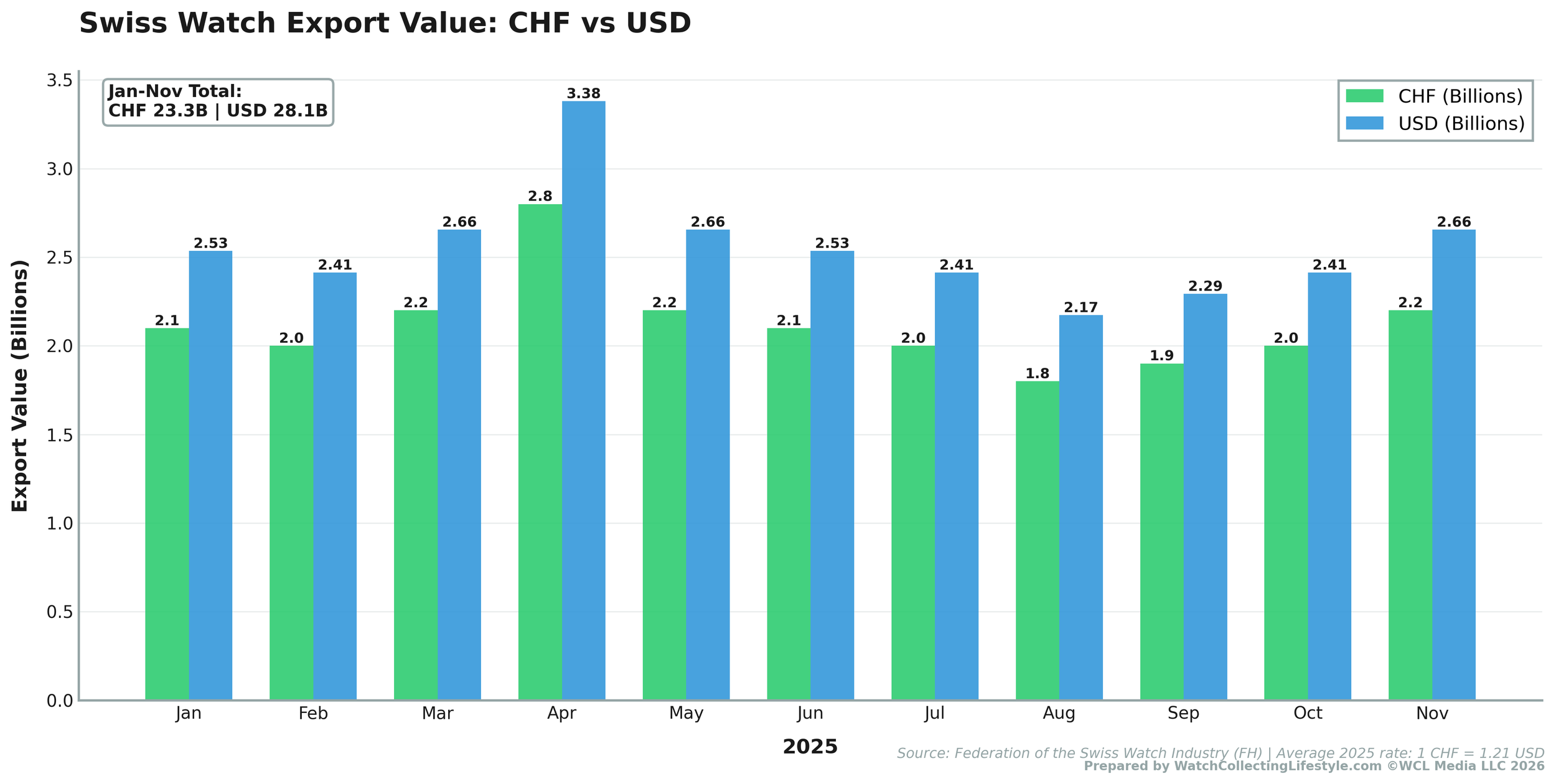

The tale of 2025 is really about three variables that played out simultaneously, each revealing different aspects of where luxury watchmaking stands as we close out the year. Swiss Watch Exports are worth CHF 23.4 Billion—USD 28.2 Billion—with 13.2 million units exported.

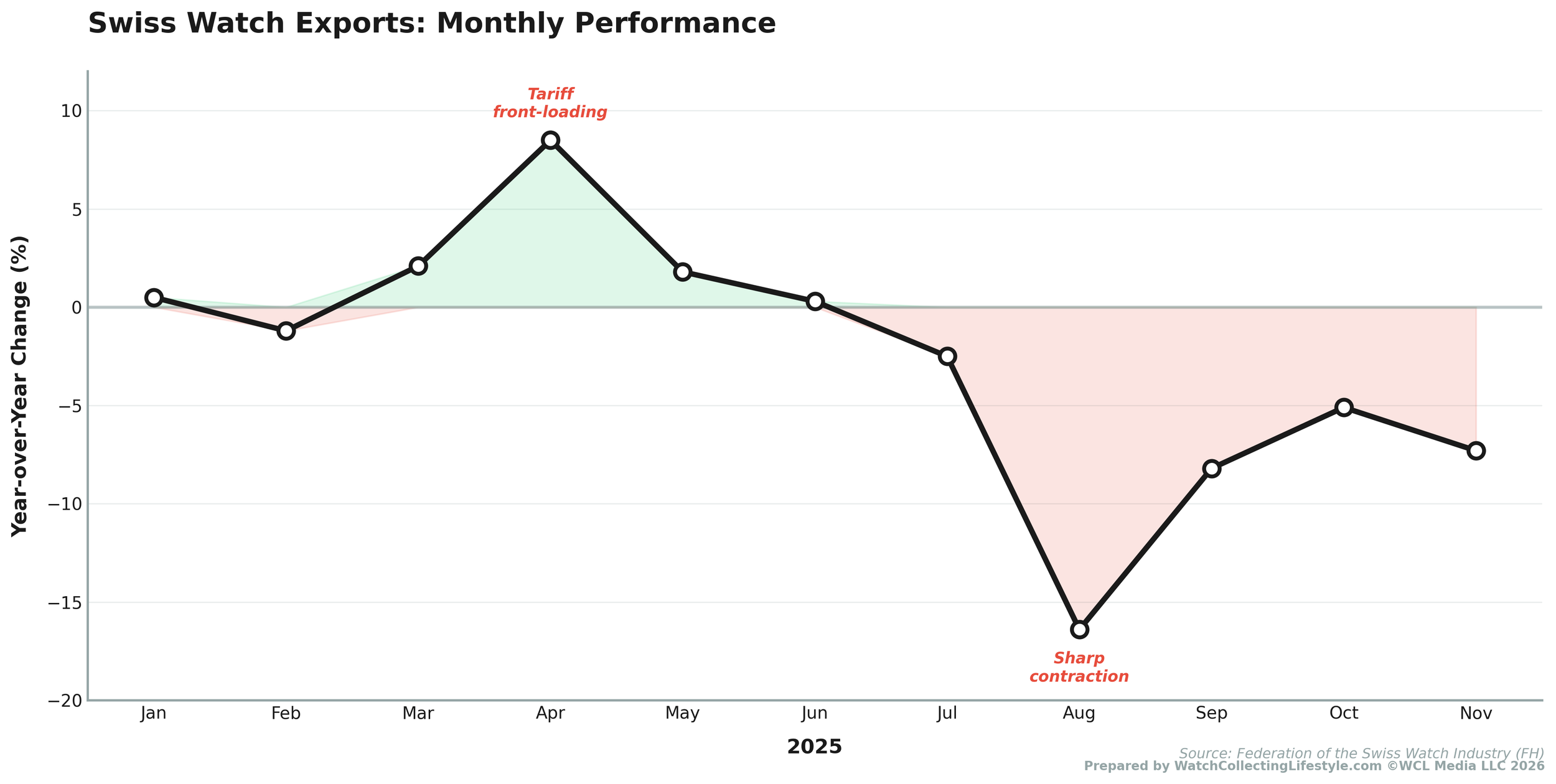

The first variable concerns the U.S. market and shows unusual volatility. April 2025 alone recorded a 150% increase over the prior year as manufactures and retailers front-loaded shipments ahead of the anticipated tariffs—a strategic response that artificially inflated first-half figures. By August, a steep decline took place as that artificial demand evaporated. The year's final numbers will reflect this recalibration , but at this point, the cumulative figure is a 2.1% decrease relative to 2024. What's significant isn't the volatility itself but what it reveals about the industry's adaptability in responding to changing trade policy conditions.

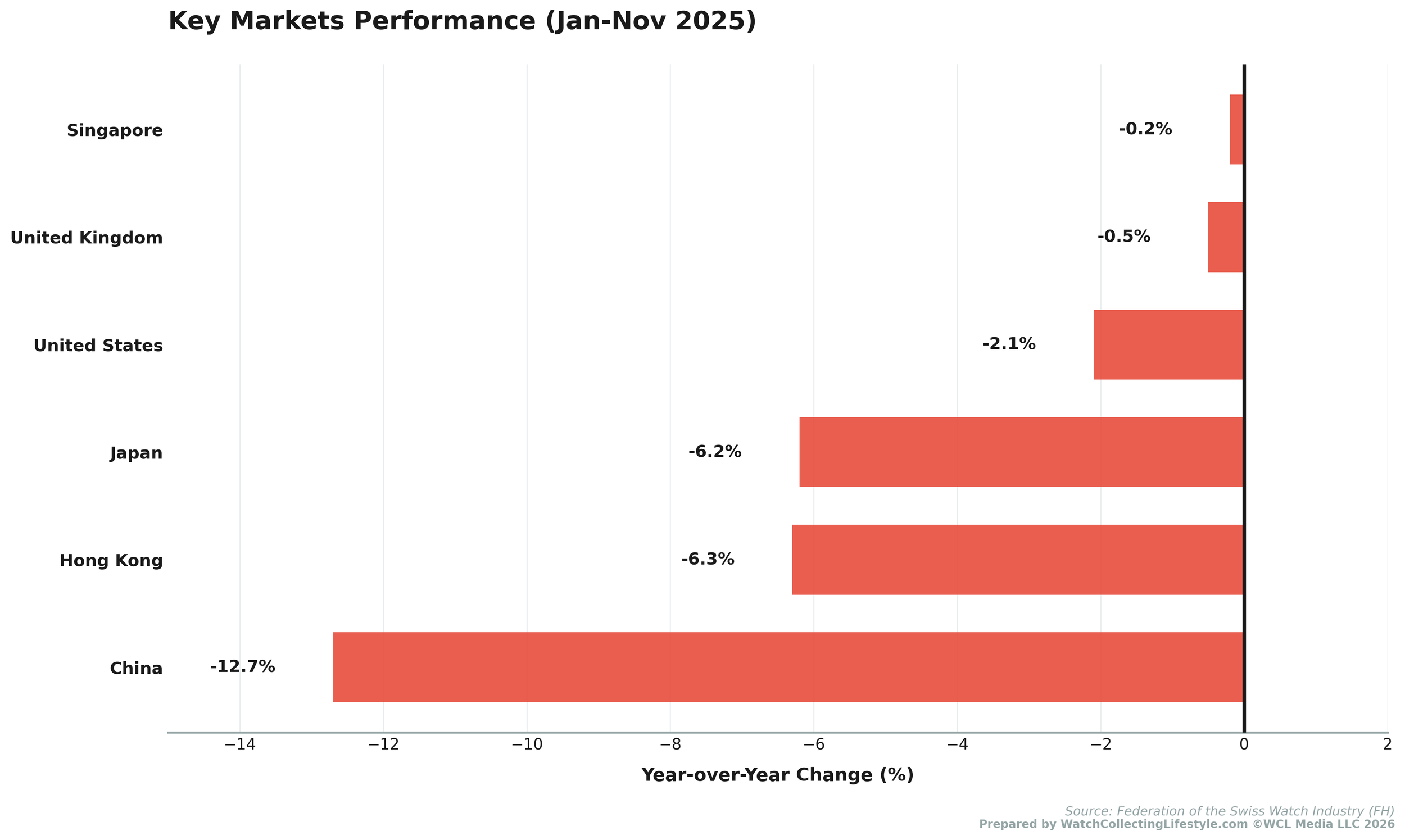

The second variable unfolds across Asia, the most important region for the Swiss Watch Industry—46% of total exports—, where the geographic center of luxury watch consumption continues to shift. China's contraction deepened to 12.7% for the year, with exports falling to CHF 1.66 billion—a sharp 36% decline compared to 2023 levels. Hong Kong followed with a 6.3% decrease to CHF 1.64 billion, extending a two-year decline that has fundamentally altered the region's importance.

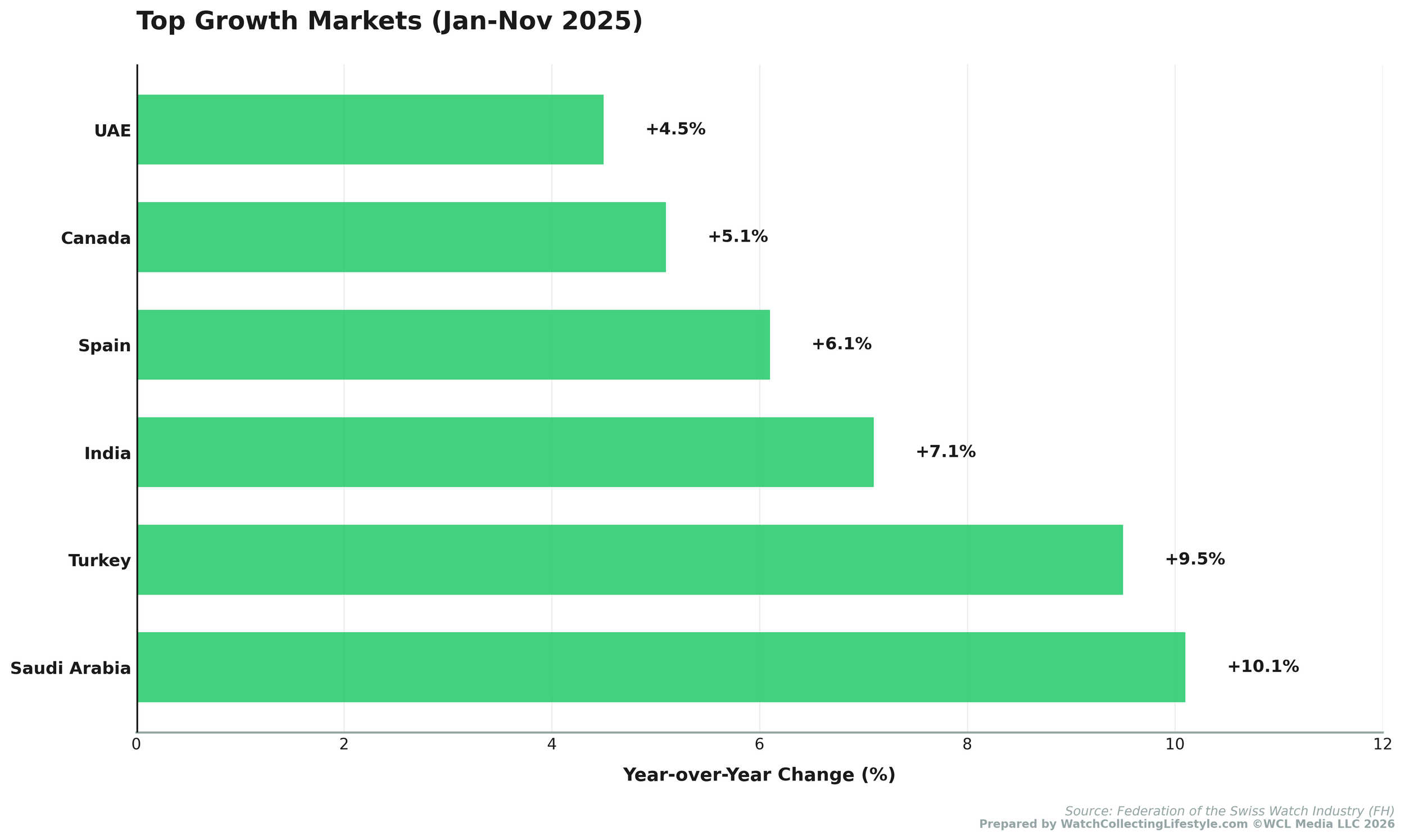

Meanwhile, Japan's 6.2% drop to CHF 1.71 billion signals that even traditionally stable markets face headwinds. The bright spot remains in the Middle East, where Saudi Arabia’s exports grew 10.1%. Other countries that experienced growth include several African countries, Turkey, India, and Spain; however, this growth cannot offset the losses elsewhere in Asia. This isn't a temporary fluctuation; it reflects a structural rebalancing in the distribution of Swiss watches.

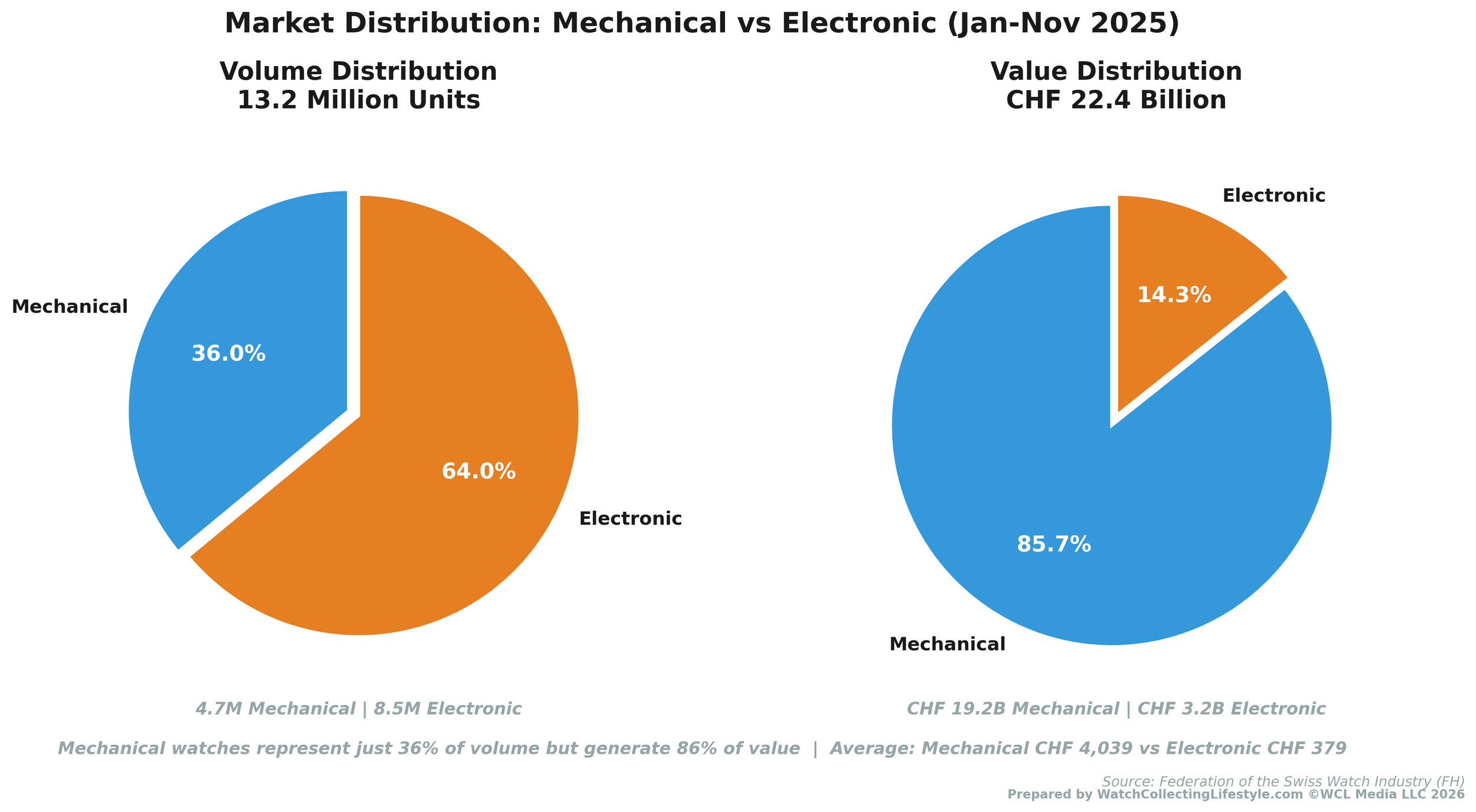

The third variable emerges in the relationship between volume and value, revealing how the industry has adapted its positioning. Through November 2025, wristwatch exports fell 6.0% in volume to 13.2 million units but only 2.2% in value to CHF 22.4 billion. Mechanical watches, which account for 86% of export value, saw volume decline by 4.3%, while value fell by just 2.1%, indicating stronger pricing power than their electronic counterparts. The data also suggest that, although fewer watches were exported from Switzerland, those that were exported commanded higher average prices. This isn't a story of declining demand; it's evidence of the importance and sustained relevance of mechanical watches and the pricing associated with it.

The brands that maintain clear positioning, compelling products, and disciplined distribution are capturing value even as overall volumes contract. The very high end has proven remarkably resilient, with rare, desirable pieces from established brands continuing to attract strong demand. Nevertheless, watches priced below CHF 3,000—USD 3,600—faced headwinds from smartwatch competition and shifting consumer preferences, but this polarization isn't a crisis—it's the market clarifying what it values. Brands with strong identities, compelling products, and disciplined positioning are still thriving in this environment. However, the resilience of the mechanical watches segment indicates that Swiss watchmaking's core value proposition—craftsmanship, heritage, and enduring design—remains compelling to consumers willing to invest in timepieces that transcend technological cycles.

The cumulative January-November figures, down 2.2% in value and 5.5% in volume, follow a similar trajectory to 2024. Two consecutive years of adjustment, combined with tariff uncertainty and geopolitical complexity, indicate that the industry is navigating through structural evolution rather than temporary disruption. The Federation of the Swiss Watch Industry FH data shows clearly which strategies are working: independent manufactures with distinctive identities are finding engaged audiences, while brands that have maintained pricing discipline and product integrity continue to perform well. All the numbers still seem quite positive for a very uncertain year, and considering that brands like Rolex, Audemars Piguet, and Patek Philippe increased prices.

What makes 2025's data particularly valuable is what it reveals about which forces will shape luxury watchmaking's next chapter. The very high end continues to attract spending even as broader economic conditions shift. Brands that have invested in building genuine desirability through innovation, craftsmanship, and authentic storytelling are seeing dividends from that investment. The market is rewarding quality, distinction, and purpose while becoming less forgiving of mediocrity.

The Swiss watch industry enters 2026 from a position of fundamental strength, backed by centuries of accumulated expertise and a proven ability to adapt to changing market conditions. The year's export figures don't predict the future, but they do illuminate which brands and strategies are resonating with today's collectors. Those insights, properly understood, represent opportunities rather than obstacles for companies willing to meet the market where it actually is, rather than where they wish it would be. Marketing and advertising cuts at some brands significantly affected their performance and awareness, rather than improving the bottom line. We see light at the end of the tunnel, and we hope 2026 will be a year of recovery for the Swiss Watch Industry.